Rethinking how Bangladesh builds and borrows

Dr. Md. Touhidul Alam Khan, Managing Director and CEO, NRBC Bank PLC.

Bangladesh's housing and construction finance sector is poised for steady growth over the next two years. Dr. Md. Touhidul Alam Khan, Managing Director and CEO of NRBC Bank, stated in an interview with The Daily Star that this positive outlook is primarily driven by increasing demand from middle-income and semi-urban homebuyers. Despite facing challenges, NRBC Bank continues to expand its affordable housing portfolio, which currently stands at around Tk. 1,100 crore.

Additionally, the bank is preparing to launch specialized Green and Women Housing Finance products. Dr. Khan highlighted the bank's commitment to transparency, sustainability, and digital transformation as key strategies to strengthen its role in promoting inclusive and environmentally responsible housing finance.

The Daily Star (TDS): What trends are you seeing in home loan or construction finance demand in the last 2–3 years?

Dr. Md. Touhidul Alam Khan (MTAK): Over the past few years, demand for housing and construction finance has remained steady, driven by middle-income buyers and small developers supported by stable incomes and remittances. While luxury housing has slowed, semi-urban areas are seeing rising demand for small-scale construction and flat purchases. Most loan applications now come from middle-income borrowers seeking affordable housing amid urban migration. However, higher material costs, new urban planning rules such as revised Floor Area Ratio limits, and stricter bank lending criteria have raised project costs and slightly reduced new housing launches and construction finance demand.

TDS: How are interest rate movements and regulatory shifts affecting homeownership or construction projects?

MTAK: Bangladesh's housing and construction finance markets are being shaped by monetary tightening, regulatory reforms, and political shifts. To curb inflation, Bangladesh Bank raised the policy rate to 8.5% in May 2024 and removed the SMART rate ceiling, allowing market-based lending. These moves have increased borrowing costs for both homebuyers and developers, reducing affordability and slowing new disbursements. At the same time, regulatory changes and delays in urban project approvals have further disrupted timelines and weakened demand for construction finance.

TDS: What products or schemes are gaining traction?

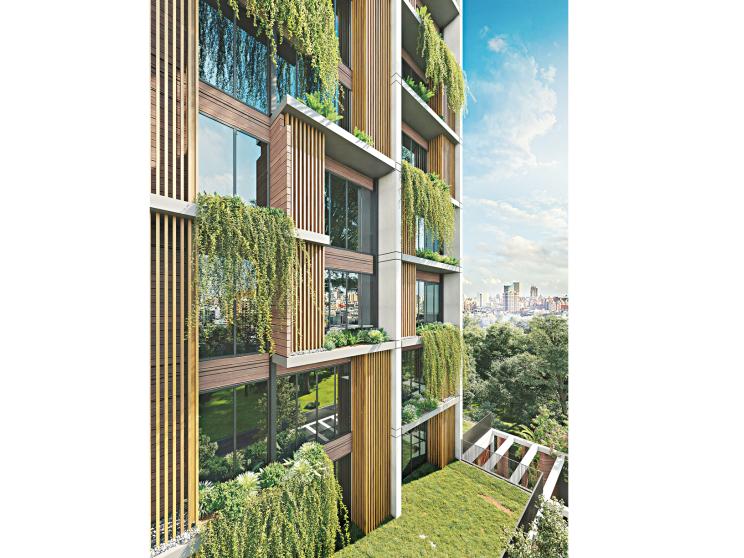

MTAK: NRBC Bank prioritises affordable housing and flat purchase loans, particularly for projects by reputed, enlisted developers. While dedicated Green and Women Housing Finance products are still in development, both are key focus areas. The bank's Green Housing concept promotes solar power, rooftop or in-compound greenery, water recycling, and eco-friendly materials such as eco-blocks. NRBC Bank also finances developer firms that meet strict due diligence and compliance standards. Its total home loan portfolio currently stands at around Tk. 1,100 crore.

TDS: What key challenges do developers or buyers face in accessing finance, and how are you addressing them?

MTAK: Accessing housing finance in Bangladesh remains difficult due to land verification issues, lengthy documentation, and high interest rates—now 12–14%—which raise costs for both buyers and developers. Liquidity shortages and reliance on short-term deposits limit long-term lending, while rising prices of steel, cement, and land reduce affordability.

TDS: How do you see urban versus semi-urban housing demand evolving?

MTAK: Urban centers will continue to see demand for smaller, well-located apartments catering to professionals and nuclear families. However, faster growth is expected in semi-urban and district towns due to better affordability, improved connectivity, and expanding infrastructure. NRBC Bank is focusing on these emerging markets by tailoring loan products and risk assessment frameworks to match local income levels and property characteristics.

TDS: Are there any innovative partnerships or digital solutions that have made housing finance easier?

MTAK: NRBC Bank is actively digitizing its operations through e-KYC, online documentation, and paperless loan processing to ensure faster turnaround times and better customer experience. Partnerships with reputable developers help maintain project transparency and safety. While AI-based credit risk models are still under development, our ongoing digital initiatives have already enhanced the efficiency and accessibility of home loan processing.

TDS: What's your outlook on the housing market in 2025–26, and how is NRBC Bank positioning itself?

MTAK: We expect steady growth in 2025–26, led by affordable and semi-urban housing. NRBC Bank is expanding flat purchase loans, financing compliant developers, and automating digital processes to enhance efficiency. Upcoming initiatives include Green and Women Housing Finance products and AI-based credit assessment tools. The bank remains focused on inclusive, sustainable housing finance that supports both customer welfare and national economic growth.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments