A rush to heal exposed banking wounds

In October, a video on social media showed the manager of Social Islami Bank’s Agargaon branch breaking down in tears after enduring harsh verbal abuse from frustrated customers seeking to withdraw cash.

28 December 2024, 18:00 PM

Agrani Bank’s health deteriorated fast in last five years

Once a reputable state-run commercial lender, Agrani Bank saw its financial health deteriorate fast over the past five years, mainly due to massive lending to politically backed businesses, mismanagement by the board and fallouts of Covid-19.

26 December 2024, 18:00 PM

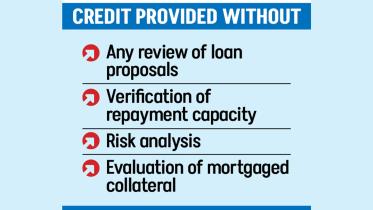

S Alam-linked firms account for 56% of loans from First Security

Companies linked to the controversial S Alam Group took out 56 percent of the total disbursed loans of First Security Islami Bank (FSIB), one of six Shariah-based lenders controlled by the Chattogram-based business giant.

25 December 2024, 18:00 PM

BB waiting for law to sue Nagad

The Bangladesh Bank is waiting for the interim government to bring a Payment and Settlement System Act, 2024 into effect, as it intends to take legal action against mobile financial service (MFS) provider Nagad Ltd over alleged irregularities.

24 December 2024, 18:00 PM

Forex market volatile again on Ramadan import rush, overdue LCs

After a five-month pause, dollar rates have started to rise, prompting the central bank to question the managing directors of 13 banks about the fresh volatility of the greenback.

22 December 2024, 18:00 PM

Explanations sought from 13 banks for higher dollar rate

BB issued letters on Dec 19 and the deadline for explanation ends today

22 December 2024, 13:43 PM

First Security Islami Bank: Almost 90pc of Tk 2,254cr loan to Sikder Group sours

As much as 89.3 percent of the credit extended by First Security Islami Bank, when controlled by the major Awami League beneficiary S Alam Group, to AL-affiliated Sikder Group by violating banking rules and regulations has become defaulted.

19 December 2024, 18:01 PM

Padma Bank seeks Tk 1,300cr bailout

Problem-ridden Padma Bank has applied to the Bangladesh Bank for Tk 1,300 crore in liquidity support to mitigate its crisis and strengthen its ability to repay depositors.

19 December 2024, 18:00 PM

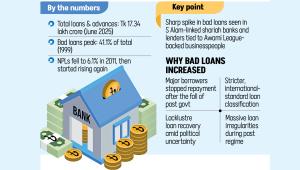

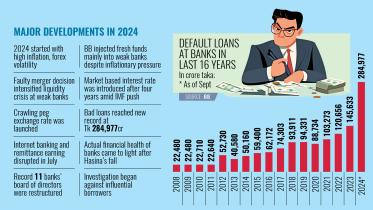

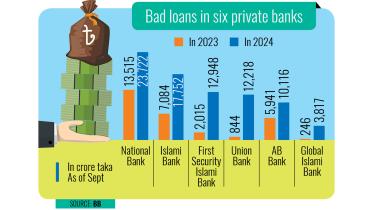

Six private banks see bad loans nearly triple in a year

Defaulted loans at six private commercial banks nearly tripled in one year till September 2024, according to central bank data, which bankers term “alarming”.

17 December 2024, 18:00 PM

Janata allowed to lend more to defaulter Beximco

State-run Janata Bank has been partly exempted from the Bank Companies Act-1991 so that it can lend money to Beximco Group, a loan defaulter.

14 December 2024, 18:00 PM

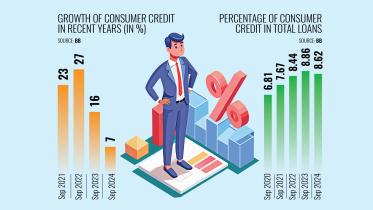

Consumer financing slows amid economic hardship, uncertainty

Consumer financing has slowed as people are adopting a go-slow strategy for taking loans, considering the increasing trend of interest rates amid ongoing inflationary pressure.

12 December 2024, 18:00 PM

Banks shun old-time Motijheel for glitzy Gulshan

Motijheel is losing its historic lustre as Dhaka’s commercial hub, with Gulshan, among the wealthiest neighbourhoods in the capital, stealing its thunder.

6 December 2024, 18:00 PM

Janata moves to recover Tk 1,260cr from AnonTex

Janata Bank is set to auction the mortgaged assets of Simran Composite Ltd

5 December 2024, 18:00 PM

FDI data overstated by $5.7b in four years

The Bangladesh Bank overstated the net foreign direct investment data by $5.7 billion between fiscal 2019-20 and 2022-23.

3 December 2024, 18:23 PM

BB reverts to bank bailout despite inflation worries

The Bangladesh Bank (BB) has backtracked on its decision to refrain from injecting fresh funds into crisis-hit banks in its efforts to curb persistent inflation.

28 November 2024, 18:00 PM

BB’s leniency to blame for ailing banking sector

Banking rules and regulations stipulate a single borrower exposure limit but the banking regulator itself disregarded the rule routinely in the last 16 years.

23 November 2024, 18:00 PM

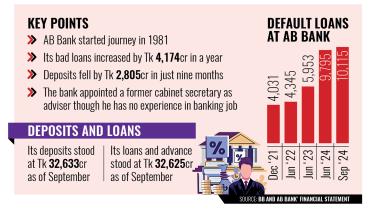

AB Bank’s health shows no signs of improvement

Once a reputable private commercial lender, AB Bank’s financial health is now deteriorating gradually due to boardroom mismanagement, loan irregularities, illegal facilities availed by its sponsors and inaccurate measures by the central bank.

23 November 2024, 18:00 PM

Social Islami Bank has no ‘untraceable’ loans

Social Islami Bank PLC stands out among crisis-hit banks with no “untraceable” loans, a factor that will catalyse its swift recovery, according to M Sadiqul Islam, the new chairman of the Shariah-based lender.

20 November 2024, 18:00 PM

Bank owners’ forum was useless during AL time

The Bangladesh Association of Banks (BAB), the private bank owners’ forum, will work with the central bank governor and the finance adviser to rejuvenate the banking sector, weakened under 15 years of Awami League rule, said its new chairman Abdul Hai Sarker.

19 November 2024, 18:00 PM

Defaulted loans may double next year

The defaulted loan figure is set to double as the Bangladesh Bank is set to tighten the classification rules for all types of loans by March next year to meet the International Monetary Fund’s loan conditions.

19 November 2024, 18:00 PM