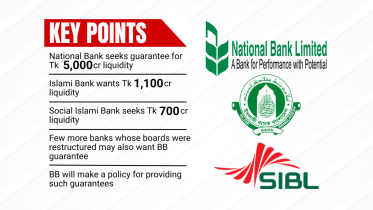

Three banks seek BB guarantee for Tk 6,800cr liquidity support

National Bank, Islami Bank Bangladesh and Social Islami Bank have applied to the Bangladesh Bank (BB) for its guarantee to avail a total of Tk 6,800 crore in liquidity support through the inter-bank money market for a period of three months.

11 September 2024, 18:00 PM

Global lenders to finance banking reforms

The Asian Development Bank (ADB) and the World Bank are expected to provide funds to Bangladesh for banking sector reforms, including strengthening and modernising the central bank.

10 September 2024, 18:00 PM

BB in $450m shady trade with Islami Bank to rebuild reserves

In the first week of July, the Bangladesh Bank and Islami Bank Bangladesh completed a US dollar-taka trade, a typical mutual currency deal, which was supposed to replenish the central bank’s dwindling forex reserves and provide the cash-strapped Shariah-based lender with some liquidity support.

4 September 2024, 18:00 PM

BB in $450m shady trade with Islami bank to rebuild reserves

In the first week of July, the Bangladesh Bank and Islami Bank Bangladesh completed a US dollar-taka trade, a typical mutual currency deal, which was supposed to replenish the central bank’s dwindling forex reserves and provide the cash-strapped Shariah-based lender with some liquidity support.<

4 September 2024, 16:20 PM

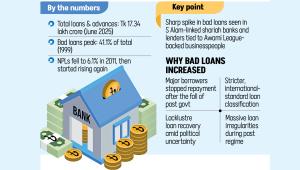

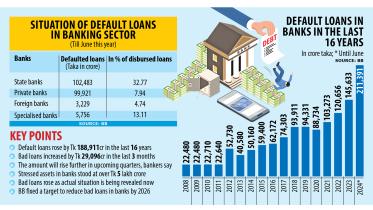

Default loans surpass Tk 200,000cr for first time

Default loans in the banking system surpassed Tk 200,000 crore for the first time, underlining the fragile condition of the sector that fell prey to rampant scams and irregularities under the tenure of the Awami League government over the past 16 years.

3 September 2024, 18:00 PM

Default loans hit record Tk 211,000cr

Default loans in the banking sector hit an all-time high of Tk 211,000 crore at the end of June of this year, as per the latest Bangladesh Bank data.

3 September 2024, 12:19 PM

BB’s strange bid to save Orion plant

Three state-run banks far exceeded their limits to salvage a coal-fired power plant project of an Orion Group subsidiary, which was stalled for six years, with Tk 10,579 crore in loans thanks to policy relaxation by the Bangladesh Bank under the now-ousted Sheikh Hasina government.

2 September 2024, 18:00 PM

Assess loan exposure to influential people

The Bangladesh Bank (BB) has instructed the recently restructured banks to identify and assess their loan exposure to politically exposed and important persons as they might fail to repay the loans.

2 September 2024, 18:00 PM

How Islami Bank was taken over ‘at gunpoint’

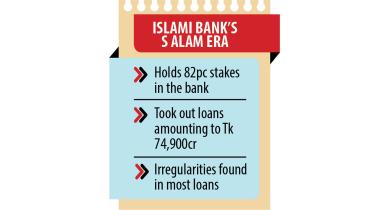

Islami Bank, the largest private bank by deposits in 2017, was a lucrative target for Sheikh Hasina’s cronies when an influential business group with her blessing occupied it by force – a “perfect robbery” in Bangladesh’s banking history.

31 August 2024, 18:00 PM

Fixing boards of ailing banks is first step for good governance

Reconstituting the board of directors of ailing banks is the first step towards bringing good governance and discipline to the banking sector, according to Bangladesh Bank Governor Ahsan H Mansur.

29 August 2024, 18:00 PM

The long, dark past of UCB

The central bank has just reconstituted the board of United Commercial Bank (UCB) for financial wrongdoings, but it has a darker past – a takeover at gunpoint by a politically influential family over a quarter of a century ago.

28 August 2024, 18:00 PM

S Alam barred from fund transfer, cashout, LC opening

The Bangladesh Bank yesterday instructed six S Alam-owned banks to stop any money going out of the accounts in the name of the Chattogram-based business giant, its associates’ companies and related persons.

26 August 2024, 18:00 PM

Orion Pharma’s Tk 132cr loan rescheduled with special approval

Orion Pharma Ltd, a pharmaceutical company of Orion Group, has been provided a rescheduling facility on a forced/demand loan by state-run Agrani Bank with special approval from the Bangladesh Bank.

26 August 2024, 18:00 PM

BB appoints administrator at Nagad

The Bangladesh Bank yesterday appointed an administrator to Nagad after one too many allegations of irregularities in the mobile financial service provider’s operations and dealings.

21 August 2024, 18:00 PM

Islami Bank finally freed from S Alam Group

After seven years, S Alam Group’s control over Islami Bank ended yesterday after the Bangladesh Bank decided to dissolve the board of the country’s largest private sector bank that was heavily dominated by individuals linked to the conglomerate.

21 August 2024, 18:00 PM

S Alam group, associates: Tk 95,000cr loans taken from 6 banks

S Alam Group and its associate companies took out Tk 95,331 crore between 2017 and June this year from six banks, with 79 percent of the sum coming from Islami Bank.

19 August 2024, 18:00 PM

Six banks still in shortfall despite BB support

Six banks including four Shariah-based ones are still facing a deficit in their current accounts with the central bank despite special liquidity support.

18 August 2024, 21:00 PM

Sonali Bank asked to show Orion’s loan as defaulted

The Bangladesh Bank instructed state-run Sonali Bank to classify the Tk 106 crore loans taken by Orion Infrastructure Ltd as defaulted since the client repeatedly failed to repay on time.

18 August 2024, 18:00 PM

S Alam drains Janata branch dry

As much as 90 percent of the loans disbursed by a branch of state-run Janata Bank was for S Alam Group, in yet another instance of how the Chattogram-based business giant exerted its influence on the country’s banking sector.

17 August 2024, 18:00 PM

Loans from Janata, NBL: S Alam, Nassa got Tk 2,544cr waiver in breach of rules

Chattogram-based conglomerate S Alam Group and garment manufacturer Nassa Group were given interest waivers amounting to Tk 2,544 crore bypassing banking rules, in a testament to the outsize influence oligarchs had on the banking sector during the Awami League-led government of the past 15 years.

15 August 2024, 18:00 PM