US tariff hike no big blow to non-leather footwear exports

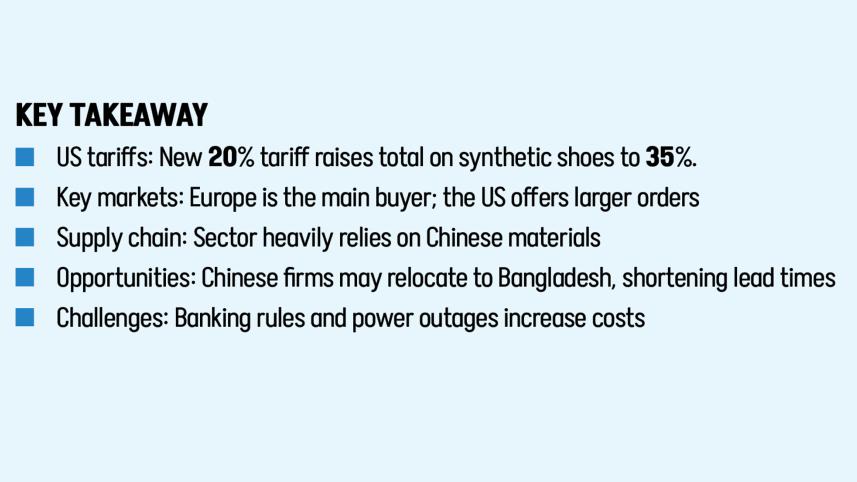

Emerging export item non-leather footwear remains largely unscathed after the US tariff storm, thanks to Bangladesh's limited exposure to the American market and a stronger competitive position than some peers.

The sector, which has recently entered the half-a-billion-dollar export club from $189 million a decade earlier, is seeing American buyers returning to Bangladeshi exporters, according to a leading industry figure.

"US buyers have done their calculations and seem ready to absorb the 35 percent tariff for now," Riad Mahmud, managing director of Shoeniverse Footwear, told The Daily Star in a recent interview.

Mahmud, who supplies products to top buyers like Walmart, Target, and Reebok, said, "Bangladesh can still emerge as a major player in the global synthetic footwear market despite recent tariff pressures."

Around 90 percent of Bangladesh's non-leather footwear exports currently go to Europe. But Mahmud sees greater promise across the Atlantic.

"US orders are large and consistent. When one style runs on the line for weeks, our efficiency improves. Europe's orders are smaller and fragmented. Constant style changes reduce output and raise costs," the Shoeniverse MD said.

Just months ago, top US retailers were exploring Bangladesh as an alternative sourcing base amid shifting global trade dynamics. The sudden introduction of a 20 percent US tariff on Bangladeshi products, on top of an existing 15 percent, had initially put a damper on that optimism.

The tariff hike, Mahmud said, was "like a fog rolling over clear skies." Half his confirmed orders were frozen almost overnight. "Buyers simply said, 'We'll get back to you.'"

Faced with idle capacity, Shoeniverse pivoted to lower-margin clients to keep its factory floors busy. "We didn't earn profit, but we avoided empty lines. It was survival." Now, orders for November and December are back on the books.

Building Resilience

To compete sustainably, Mahmud argues, Bangladesh needs the scale and stability that the US market offers. The tariff shock, he says, also exposed structural weaknesses, particularly the high dependence on Chinese raw materials, which stretched lead times to 90 days.

To address this, Shoeniverse is offering land and infrastructure at its Bhaluka industrial zone to Chinese suppliers willing to form joint ventures in Bangladesh. "If components like soles and uppers are produced here, we can cut lead times from three weeks to three hours. That's how you withstand external shocks—not by lobbying, but by building smarter."

Mahmud likened the current crisis to emergency surgery. "We didn't have time to prepare; we simply had to respond. But now we must plan our recovery and future growth."

He estimates Bangladesh's footwear exports could reach $1 billion in two and a half years if key hurdles are cleared. Chief among them is the Nirapon certification, which guarantees US-standard safety and compliance.

"It took Parasol 18 months to secure theirs. Without it, we can't access high-volume US orders," he said, adding that several other firms, including Pran-RFL and MAF Shoe, are also pursuing the certification.

Beyond America

Beyond the US, Mahmud sees potential in the Australian market, which is also seeking alternatives to China.

Besides, Vietnam's rising costs and capacity limits could push European and Australian buyers towards Bangladesh. "Bangladesh is well positioned to benefit, if we act fast."

With Bangladesh's graduation from the least developed country category approaching next year, Mahmud warns that Europe alone cannot sustain growth. "To recover our investments, we need bigger buyers from larger economies."

Mahmud was pragmatic on the US push for stronger labour unions. "As long as it's not disruptive, I believe in labour rights. We've already implemented 8-hour shifts and overtime limits. We've rejected child labour. These are global standards, and we accept them."

"The human and mental cost of violating these rights is too high, far beyond any financial calculation," he added.

Policy and Power

To ensure long-term competitiveness, Mahmud called for reforms in banking regulations.

"Payment cycles with US buyers can exceed 90 days, but current policies don't accommodate that. Also, occasional penalties for defective shipments are flagged as suspicious by banks, even when they're legitimate business practices," said the exporter.

Energy supply is another pressing issue. "We often face 6 to 8 power outages a day. That forces us to rely on gas or diesel generators, raising our production costs significantly."

Despite the hurdles, Mahmud remains hopeful.

"This is our RMG moment," he said, referring to the boom of Bangladesh's readymade garment sector, the crown jewel of the country's export industry.

"If we localise supply chains, ensure compliance, and scale up, we can replicate the garment sector's success in footwear," he noted.

The tariffs, he said, have not shut the US market. "The door is still open, just with a higher threshold. The opportunity remains. Now it's on us."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments