Banks still slack on security at ATMs

Banks installed anti-skimming devices only on 20 percent of automated teller machines in the last three months since the central bank's order to do so -- to tighten security after fraudulent cash transactions at ATMs.

Bangladesh Bank, in a notice on February 14, asked the banks to install anti-skimming devices and PIN shields in all ATMs within a month.

Bankers said they are still in the procurement stage even though three months have passed.

“Anti-skimming devices are in-built in some ATMs, which have been bought in recent times. In addition, the devices have been set up in 20 percent of all ATMs,” said Subhankar Saha, executive director and spokesman for the central bank.

“Progress remains lower than expected.” Banks are taking time in the name of procurement and installation, he added.

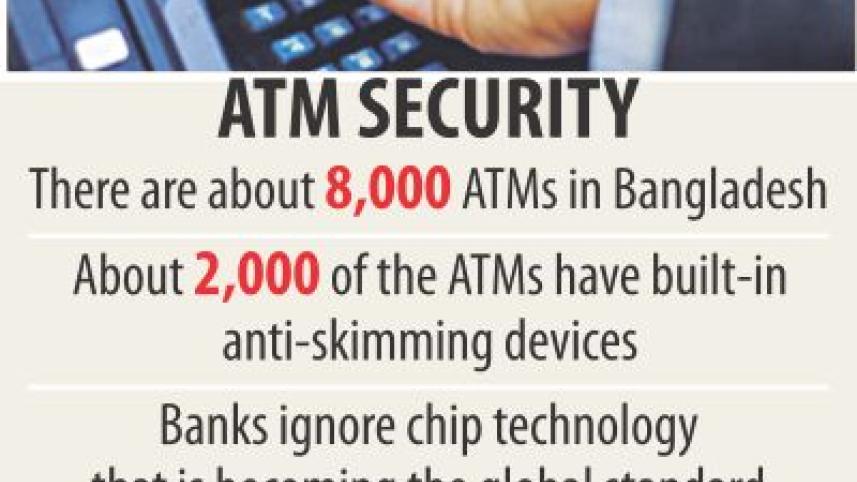

There are about 8,000 ATMs in Bangladesh and about 2,000 of those have in-built anti-skimming devices, leaving a majority of the machines still vulnerable to easy fraud, according to industry insiders.

The BB's directive came after fraudulent cash transactions were detected at six ATM booths of three banks in early February, involving 40 cards and a sum of over Tk 25 lakh.

Fraudsters stole the data of at least 2,000 cards by placing skimming devices in those ATMs, according to the BB. But industry insiders said the number would be 4,000-5,000.

Investigators later arrested six persons, including a foreigner and his three accomplices, who were marketing executives of a private bank.

The incidents rattled the banks and their customers, who are increasingly relying on ATMs to withdraw cash.

The recent detection of an illegal cash-out by a Chinese national at an ATM booth of Prime Bank in Dhaka also worried bankers as well as customers.

“You can never stop these frauds. It seems to me that we should go back to the manual system,” said Ahmed Kamal Khan Chowdhury, managing director of Prime Bank, the latest victim of card frauds.

A Chinese national was caught red-handed withdrawing money using a forged card from an ATM of Prime Bank on March 18. He was held with Tk 66,000 that he withdrew by using a card issued by a Saudi bank from the ATM booth.

Chowdhury said fraudsters took away around Tk 7.5 lakh on that day from their booths by using forged cards.

The ATM has evolved as an important part of the financial infrastructure for cash withdrawal, since being introduced on a large scale just a decade ago.

While the majority of the automatic tellers do not have simple anti-skimming devices and PIN shields, banks also ignored issuing chip technology that is becoming the global standard for credit card and debit cards. Chip-enabled cards store their data on integrated circuits rather than magnetic stripes.

Industry insiders said some banks have even invested in substandard technology tellers to save money, which puts the system at risk.

Abul Kashem Mohammad Shirin, deputy managing director of Dutch-Bangla Bank, said only the WINCOR brand of ATMs have in-built anti-skimming devices. The NCR brand of ATMs has anti-skimming devices, but buyers have to pay a licence fee to run the device, which many banks did not purchase, he said.

When asked to comment, a senior official of Al-Arafah Islami Bank said: “We have recently placed ads to procure the devices, and installation will take time.”

On the quality of the ATMs used by banks, an official of another private bank said six ATMs, which were skimmed in February in Dhaka, were of the same brand -- NCR -- and provided by a single supplier. But there are four vendors who sell NCR brand ATMs in Bangladesh.

“An ATM is a secured terminal, like a bank cashier or bank vault, and it's a proven technology that has been used globally for a long time now. Are we using lower graded ATM machines, which are easily accessible by the scammers?” he asked.

About two to three lakh transactions worth around Tk 500 crore take place through ATMs a day in Bangladesh.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments