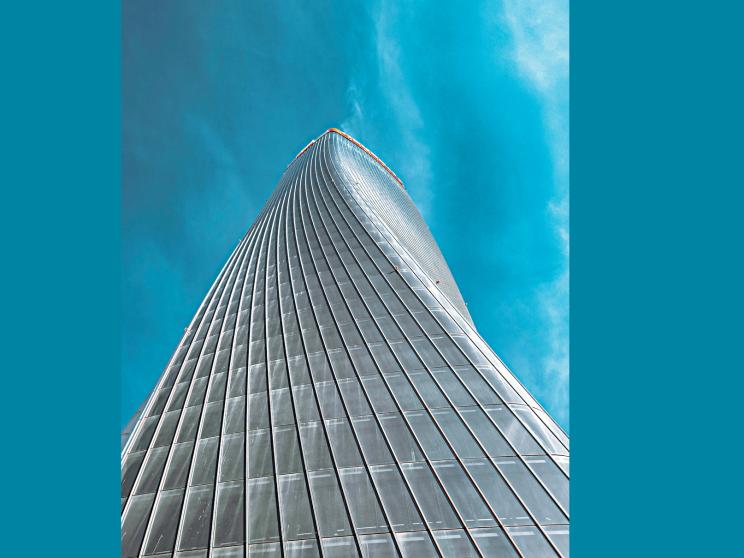

Shariah-Compliant residence

Mosleh Uddin Ahmed, Managing Director, Shahjalal Islami Bank PLC.

The housing sector in Bangladesh continues to face unique challenges and evolving demands. Shahjalal Islami Bank PLC. leverages interest rate movements, the growing importance of semi-urban housing with Shariah-compliant products and digital solutions to support a diverse range of customers and foster sustainable growth in the market.

The Daily Star (TDS): What trends are you seeing in home loan or construction finance demand in the last 2-3 years?

Mosleh Uddin Ahmed(MUA): In the last 2-3 years, due to political turmoil, there has been a significant decline in the other investment sectors of Bangladesh. But as the dwelling place is a basic need of people, we do not observe any sharp decline in house building investment like other investment sectors. It is also true that there is no increasing growth in this sector, but we may say that a constant growth is achieved.

TDS: How are interest rate movements and regulatory shifts affecting homeownership or construction projects?

MUA: In the last 2-3 years, the profit rate has moved from 9% per annum to 14% per annum. Such movement affects the large-scale developer construction, and it has also affected the personal-level construction. On the other hand, regulatory shift has almost no effect on this sector.

TDS: What products or schemes (e.g., green housing loans, women's housing finance, SME developer financing) are gaining traction?

MUA: At present, we do not have specific products such as Green Housing Loans or Women's Housing Finance in our portfolio. However, we offer similar Shariah-compliant investment products that promote inclusiveness, sustainability, and ethical growth in housing investment. We also encourage our clients to include several sophisticated technologies, like solar panels, to have green energy.

For instance, we have included semi-pacca house building products to spread such investment in the rural areas of the country. Our home finance facilities under HPSM cater to a wide range of customers while encouraging responsible home ownership and asset-backed investment. We also emphasise financing for women entrepreneurs and small business owners through our SME and Retail Investment Schemes.

TDS: What are the key challenges developers or buyers face in accessing finance, and how are you addressing them?

MUA: Developers primarily face hurdles related to documentation and compliance, often delaying project approvals, along with equity and collateral constraints. Project risk and cash flow mismatches further complicate financing continuity. Additionally, a limited understanding of Islamic financing modes sometimes creates reluctance.

For buyers, the main obstacles include high property prices and an affordability gap. Lengthy approval processes are being streamlined through simplified procedures. As per the rules of the regulatory body client could not demand more than Tk. 2.00 crore in this sector. Besides client's participation should be a minimum of 30% of the purchase price. But in areas like Gulshan, Banani, and Baridhara, the price of a flat is much higher. In those areas, demand for house finance is also higher, but for regulatory reasons, we cannot provide house finance of more than 2.00 crore. Vague agreement between the land owner and the developer regarding flat distribution. The bank advises performing a complementary deed or a correction deed to remove such vague distribution.

TDS: Are there any innovative partnerships or digital solutions (apps, paperless processing, AI risk tools) that have made housing finance easier?

MUA: Our clients can impose a standing instruction to deduct their instalment from their savings and current accounts. They can also pay the instalment from anywhere through our 141 branches around the country. They can observe their investment account statement through our instantly updated app by sitting their home. Besides, the client may pay their instalment by using our digital app Shajalal Touch Pay. We are in under process of introducing paperless processing of housing finance.

TDS: What is your outlook on the housing market in 2025-2026, and how is your bank positioning itself to support that growth?

MUA: Expected house building growth in Bangladesh for 2025-2026 is mixed, with the broader construction sector predicted to slow due to political and economic factors. However real estate market is still projected to grow, driven by urbanisation, population growth and demand for modern and sustainable housing. As a secured investment, our bank will also emphasise increasing its market share of house building through reducing the rent rate, by signing MOUs with different prominent developers and by marketing.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments