Bad loans

A third of NBFIs hold over 73% of bad loans

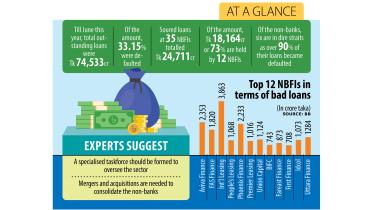

Twelve non-bank financial institutions (NBFIs) out of a total 35 are holding nearly 73.5 percent of the sector’s bad loans, according to Bangladesh Bank data, reflecting a precarious situation at those entities.

5 November 2024, 18:00 PM

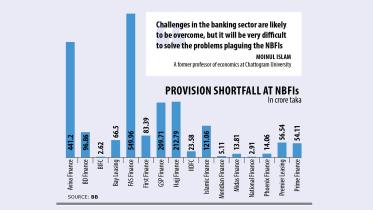

16 NBFIs face total provision shortfall of Tk 1,954cr

Sixteen non-bank financial institutions (NBFIs) faced a combined provision shortfall of Tk 1,954 crore till June this year, reflecting that their financial health had worsened.

13 October 2024, 18:00 PM

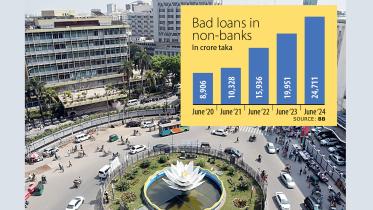

Non-banks’ default loans hit record high

Non-bank financial institutions (NBFIs) in the past fiscal year saw their defaulted loans reach a record 33.15 percent of all disbursed loans, according to the central bank, indicating a fragile situation in the sector thanks to widespread loan irregularities and scams.

6 October 2024, 18:00 PM

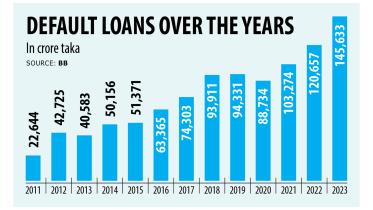

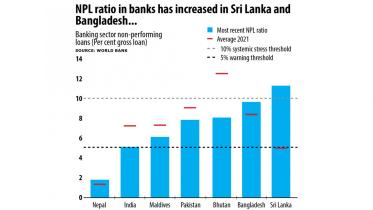

Politically-motivated lending causing bad loans to spiral: WB

The amount of bad loans has been spiralling in Bangladesh owing to rampant politically-motivated lending and inadequate credit risk management, according to a World Bank report.

29 July 2024, 18:00 PM

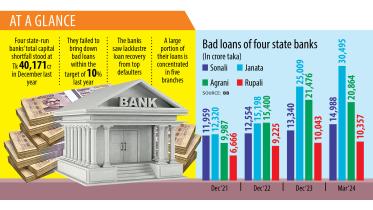

State banks nowhere near target to retrieve funds from top defaulters

Four state-run banks in Bangladesh are finding it difficult to recoup loans from their top 20 defaulters, a failure that has worsened their financial health and squeezed their capacity further to lend.

9 July 2024, 18:00 PM

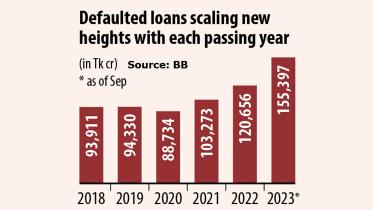

Bad loans hit historic high

Default loans in the banking sector of Bangladesh hit an all-time high of Tk 182,295 crore, but no reform programme to reduce it has been announced in the budget for the upcoming fiscal year.

6 June 2024, 18:00 PM

Default loans hit historic high of Tk 1,82,295 crore

Bad loans rose by Tk 36,367 crore in just three months

6 June 2024, 10:51 AM

BB roadmap to knock down bad loans

The Bangladesh Bank yesterday unveiled its roadmap for reining in the runaway defaulted loans to a reasonable level and bringing in good governance to the banking sector, which is progressively becoming an Achilles heel of the economy.

4 February 2024, 18:00 PM

Bangladesh 2nd in South Asia in bad loan ratio

Bangladesh’s banking sector has the second-highest ratio of non-performing loans (NPL) among the countries in South Asia as lenders continue to face multiple challenges emanating from scams, a lack of corporate governance and borrowers’ growing reluctance to make instalments regularly.

13 May 2023, 18:00 PM

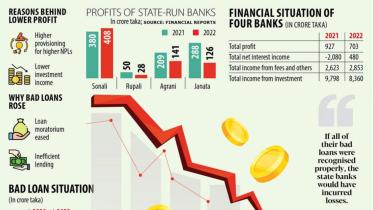

Bad loans pile up at state banks, eating away profits

Four state-run commercial banks registered 29 per cent year-on-year spike in bad loans in 2022 as the central bank’s relaxed classification rules introduced in the wake of the Covid-19 outbreak ended and their inefficient lending persisted.

9 May 2023, 05:00 AM

Bad debts going worse

Misgovernance, corruption, nepotism and subsequent bad debts keep plaguing our banking landscape.

5 December 2022, 13:00 PM

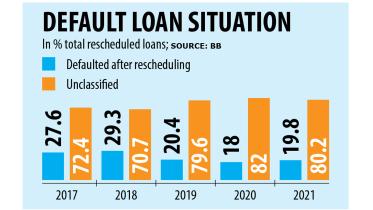

Rescheduled loans too turning bad

The Bangladesh Bank’s policy that allows defaulters longer repayment tenures and easy terms and access to fresh funds has appeared to have failed to make major inroad in bringing down bad debts as rescheduled loans are even turning sour.

20 October 2022, 02:10 AM

The two economic problems we can’t seem to overcome

There are two major economic problems that have been plaguing Bangladesh for a long time: Rising non-performing loans (NPLs), and money getting laundered out of the country.

7 July 2022, 16:00 PM

Tk 1,26,369 crore loans defaulted as of March this year: Finance Minister

Finance Minister AHM Mustafa Kamal today told the parliament that as of March this year, the amount of defaulted loans in the country was Tk 126,369 crore.

22 June 2022, 16:18 PM

Bad loans put Janata in trouble

State-run Janata Bank’s provisioning shortfall has hit a whopping Tk 8,256 crore, the highest-ever deficit for any bank in the country, putting depositors’ money at risk.

23 July 2019, 18:00 PM