Bank merger: Investors pay the price; regulators, auditors escape blame

- Shareholders, depositors bear brunt of merger

- Regulators, auditors escape accountability for collapse

- Government bailout rescues five bankrupt banks

- Bank insiders benefit, ordinary investors lose

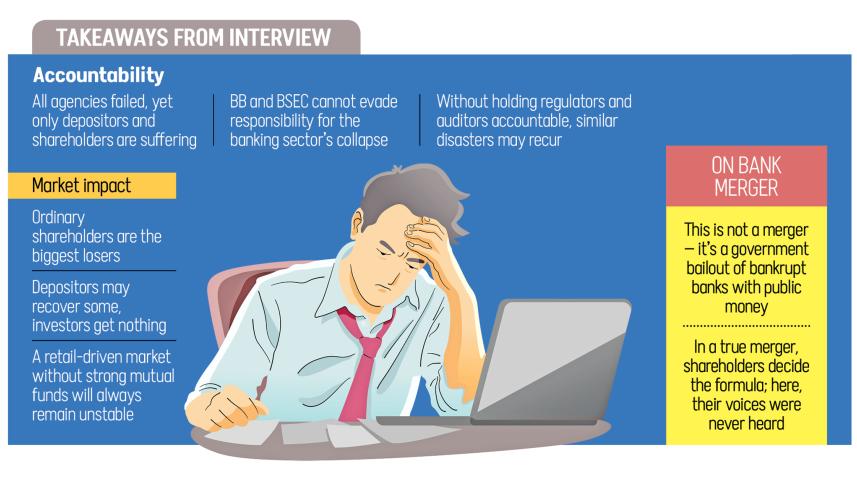

Shareholders and depositors of the five shariah-based troubled banks are bearing the brunt of the government-led merger, while the parties also seen as responsible for the banks' collapse — including regulators, auditors, and credit rating agencies — are going scot-free, said Saiful Islam, president of the DSE Brokers' Association of Bangladesh (DBA).

In an interview with The Daily Star, he said the dire state of the banks is the outcome of a collective failure across the entire supervisory chain: the central bank, the Bangladesh Securities and Exchange Commission (BSEC), the Ministry of Finance, auditors, credit rating agencies, and market intermediaries.

"Yet, we have not seen the regulators take any responsibility or even verbally admit liability. Nor have we seen any regulatory precautions to ensure this does not happen again. Instead, shareholders and depositors have ended up as the biggest losers," he said.

Stock exchanges recently suspended share trading of the five banks — First Security Islami Bank, Social Islami Bank, Union Bank, EXIM Bank, and Global Islami Bank — after confirming that their net asset value per share had turned negative, leaving shareholders with no claim in the new entity under the Bank Resolution Ordinance 2025.

Islam said the collapse was not caused by a crisis beyond human control. "This was not an act of God, nor a national disaster. It was manipulation orchestrated by certain people, while everyone else allowed it to happen."

"No one raised a red flag about what was going on. At the very least, auditors knew; the credit rating agencies knew they were issuing fake ratings; and regulators, especially the central bank, certainly knew what was happening. This is collective failure," he said.

He added that unless regulators, auditors, and rating agencies are held accountable, "there is no guarantee similar incidents will not recur."

"NOT A MERGER; IT'S A BAILOUT"

Islam, also a director of BRAC EPL Stock Brokerage, said the move has been most destructive for equity investors. "Depositors will get some of their money back, but shareholders will get nothing."

He argued that the process does not resemble a merger as defined in the Merger and Acquisition Act.

"In a proper merger, the banks would sit together, agree on a formula, and seek shareholder approval. None of that happened."

According to BB's own position, the rights of ordinary shareholders cannot be protected because the banks' net worth is already negative.

"It is more of a bailout. The government is trying to rescue five bankrupt banks using public funds," he said.

He added that in a bailout, shareholder consent is not required. "A bailout means your company is effectively bankrupt. In such cases, shareholders no longer exist because their shares hold no value. Without government intervention, these banks would have closed."

"BANK INSIDERS BIGGEST BENEFICIARIES"

According to Islam, the individuals who oversaw the decline of the banks will walk away untouched and gain the most from the merger.

"Bank directors siphoned off funds and are now the biggest beneficiaries. Those who worked within these banks are now being told that no one will lose their job. The insiders who witnessed all these irregularities are escaping any accountability, while ordinary shareholders bear the burden," he said.

But the DBA president also took a jibe at the investors for not being "responsible" with their money.

He pointed out that it is common sense to invest responsibly and perform due diligence. "They should know what they are investing in. If someone has invested in the wrong place for years, they too must share part of the responsibility."

Even so, he acknowledged that many invested based on BB-ratified financial statements. In this context, he proposed that the government could consider an equity swap under special consideration, first identifying the ordinary shareholders and then offering them a few shares in the new bank.

"For example, one or two shares in the new bank for every ten previously held. It would help restore market confidence."

The veteran investment expert recommended that investors seek the advice of financial or capital market advisers before putting money into a firm, as financial statements in our country cannot be fully trusted.

He assumes the investors of the said banks probably did not follow the aforementioned method. "That's why I say none of us can avoid our share of responsibility."

"STORY DOES NOT END HERE"

Islam warned that the five banks are not the end of the problem.

"Are these five banks the end of the story? I can say without hesitation that they are not. There are more to come."

He said a broader bailout covering all weak banks would have been fairer and more reassuring for the financial sector. "As it stands, mistrust will persist because several fragile banks are still operating."

He added that similar vulnerabilities exist beyond banking. "There are companies on the capital market whose conditions are equally dire, yet their shares trade at high prices. Investors in those firms can face losses at any time, but no one seems to be paying attention."

For Islam, the deeper structural issue is the absence of strong institutional investors.

"Ideally, mutual funds should be our main institutional investors. Until the mutual fund industry grows and behaves properly, we won't overcome these issues. A retail investor–led market will never be stable, because small investors rarely understand balance sheets or the factors beyond them. Mutual funds do," he said.

He noted that reputable mutual funds avoided these weak banks long before the collapse. "Ordinary investors should enter the market through mutual funds."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments