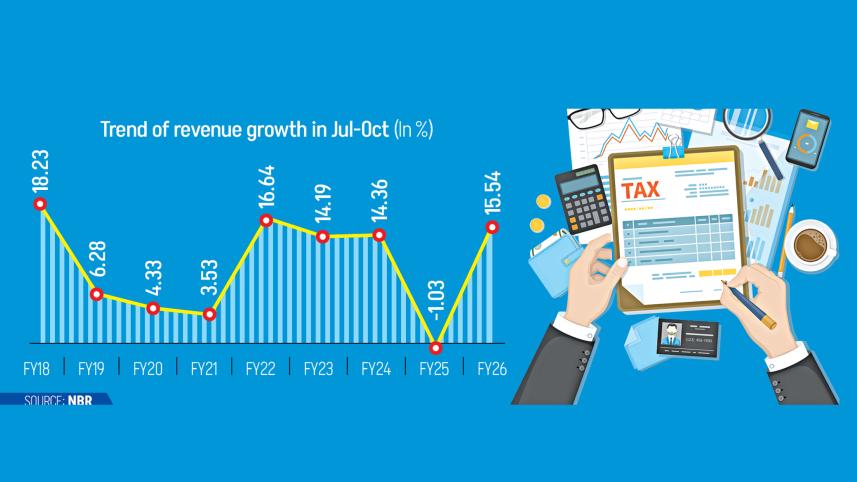

NBR logs 16% tax growth in Jul-Oct

Revenue collection rose nearly 16 percent year-on-year in the first four months of the current fiscal year, thanks to a turbulent base period last year and a more settled political and business climate now.

Even so, the figure fell short of the four-month target set by the National Board of Revenue (NBR).

A senior NBR official described the performance as "nothing special" at a time when the government, in a rare move, has raised the full-year target.

The NBR collected Tk 119,478 crore in the July-October period of fiscal year 2025-26, according to the board's provisional data.

All three main revenue streams contributed to the rise. Local level value-added tax (VAT) collection reached Tk 46,878 crore, up from Tk 37,567 crore a year earlier, marking around a 25 percent increase.

Income and travel taxes rose to Tk 37,849 crore, a 16 percent rise on the same period last year. Customs duties from international trade increased 4.53 percent to Tk 34,751 crore, due to higher imports after restrictions were eased.

Speaking on condition of anonymity, an NBR official said the July-October growth was "nothing special" because the government has raised the annual target.

"Every year, the government revises the annual target down. But this year, the target is raised, which will be challenging for the NBR," the official told The Daily Star.

Despite the rise in collection, the NBR fell short of its Tk 136,697 crore target for the first four months by 11 percent. The full-year target currently stands at Tk 499,000 crore.

The official said the gap between actual collection and target may narrow this year as the NBR has expanded its workforce by increasing tax zones nationwide.

Meanwhile, economists said that the latest growth figures need careful reading because the base period was marked by uncertainty and a shaky business climate.

After the July uprising and political changeover last year, revenue collection in the July-October period was slow. "So, comparing with that base won't give us the real picture," said Prof Abu Eusuf, executive director of Research and Policy Integration for Development.

He added that the return filing deadline in November may bring in some extra to the coffers, though hitting the full year goal will remain difficult.

The economist said that there are ongoing discussions about automation, but the systems in place are not yet able to deliver immediate results.

"So, revenue collection remains a significant challenge."

He said, "To strengthen revenue mobilisation, we must expand the tax net and ensure full end to end automation. Without true interoperability and automation, it will be extremely difficult to achieve the expected level of revenue collection."

Prof Eusuf said "We need a coordinated big push across the NBR, the private sector, bureaucracy, and other stakeholders. Without it, increasing fiscal space and addressing economic, social, and cultural rights will remain impossible."

A recent study by the Office of the United Nations High Commissioner for Human Rights said Bangladesh could collect taxes equal to 14 percent of its GDP, almost double the present rate of 6.6 percent.

Instead, the tax to GDP ratio has fallen, reflecting the country's heavy dependence on indirect taxes and limiting funds for essential services such as education and healthcare.

On Wednesday, NBR Chairman Md Abdur Rahman Khan said Bangladesh currently has 1.2 crore registered taxpayers. "But many more, especially those living in rural areas, must be brought into the formal system."

He said poorer people often shoulder a larger share of taxes, while large businesses and investors enjoy exemptions that skew the system. "This undermines fairness and limits our ability to expand direct taxation."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments