Revenue goal hiked by Tk 24,000cr on strong Q1 performance

Going against the usual practice and history, the interim government has raised the revenue collection target for the current fiscal year (FY) by 5 percent, or Tk 24,000 crore.

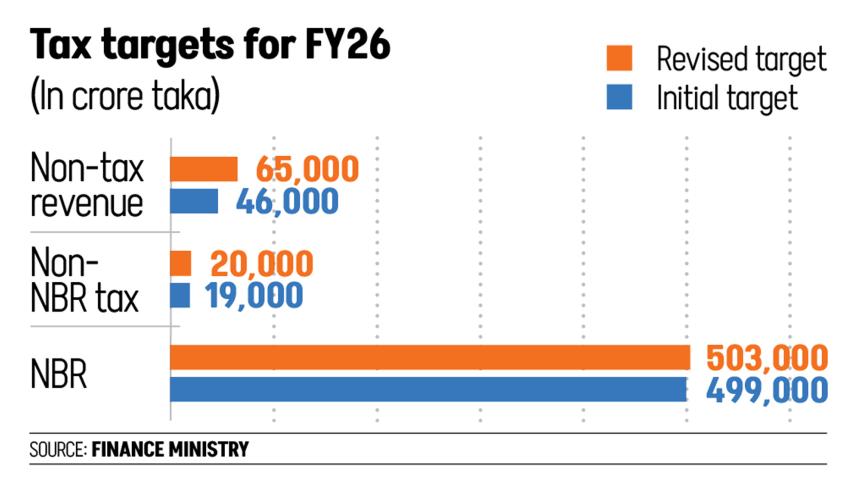

The revised target for FY2025-26 was approved at a meeting of the Coordination Council earlier this month, chaired by Finance Adviser Salehuddin Ahmed, taking the goal to Tk 588,000 crore from the original Tk 564,000 crore, a finance ministry official told The Daily Star on condition of anonymity.

The upward adjustment follows stronger-than-expected revenue performance in the July-September period. Revenue rose by 17.6 percent in the first quarter, far higher than the 4.94 percent growth recorded in the same period a year ago. With the election nearing, officials expect collections to improve further as economic recovery continues, and reform measures gain traction.

Ordinarily, revenue authorities fall short of their initial targets, and the government pares back the goal near the end of the fiscal year. Even then, the reduced targets are often missed, largely due to sluggish performance by the National Board of Revenue (NBR), which generates about 90 percent of state revenue.

Non-NBR tax targets have been increased by Tk 4,000 crore to Tk 20,000 crore, and non-tax revenue by Tk 19,000 crore to Tk 65,000 crore under the revised plan.

In recent years, NBR has even failed to meet the targets set by the International Monetary Fund under its loan programme. Despite that backdrop, the NBR's new target for this fiscal year has been increased to Tk 503,000 crore, up by Tk 1,000 crore from the original.

An NBR official said collections from customs, income tax and VAT rose notably in the first quarter, prompting the upward revision. Overall, NBR's revenue collection grew by 20.3 percent during the period, compared with just 1.9 percent growth last year, while VAT and supplementary duty collections increased by more than 22 percent.

Two former NBR chairmen said tax collection could rise further if the capacity and focus of field-level officials were strengthened.

A senior NBR official, meanwhile, pointed to seven factors behind the increased target's achievability. Chief among them is making it mandatory for all individual taxpayers to submit income tax returns online.

The e-return system also enables automated data collection from various institutions through API links - a system that enables different databases to share information directly with the NBR. For instance, banks, employers, government agencies and utility service providers can transmit taxpayer information directly to the tax authority's server. Officials expect it to curb evasion and boost compliance.

The NBR has also introduced a medium- and long-term revenue strategy with several planned measures. To raise VAT receipts, the enlistment threshold has been reduced from Tk 50 lakh to Tk 30 lakh, and the registration threshold from Tk 3 crore to Tk 50 lakh. VAT on many items has been aligned at 15 percent.

Another important reform is the split of NBR into the Revenue Policy Division and the Revenue Administration Division through an ordinance. The government also adopted a Tax Expenditure Policy and Management Framework to rationalise exemptions and tighten tax expenditure controls.

Former NBR chairman Abdul Majid said the board should be given a higher target because "it has the capacity to collect more revenue than it currently does".

With the election ahead, he said the NBR has increased scope to scrutinise candidates' declared assets against their tax records, which could uncover evasion.

He noted that a similar exercise during his tenure in 2008 resulted in significant collections, and questioned whether NBR has investigated the asset declarations and income tax files of those who participated in the 2024 election in the past one and a half years. "If that had been done, tax evasion could have been uncovered."

Regarding the new target, he added that post-election improvements in business confidence and investment are likely to support stronger revenue growth.

However, former NBR chairman Nasiruddin Ahmed said achieving the hiked target will be challenging.

"I think setting the target through the Coordination Committee meeting will not work. NBR itself should analyse the country's economic situation and revenue collection trends and set its own target," he said.

He said officials should not rely solely on automated systems but strengthen field-level enforcement to raise collections. Though he acknowledged that full automation remains the most important step for sustainable revenue growth.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments