NBFI liquidation sparks tension in stock market

- Bank mergers erased Tk 4,500 crore

- Nine NBFIs face regulator-approved liquidation

- DSE index plunged below 5,000 points

- Shareholders unlikely to recover investment value

It is a hard time to be a stock investor, especially if your money is tied up in banks and non-bank financial institutions (NBFIs).

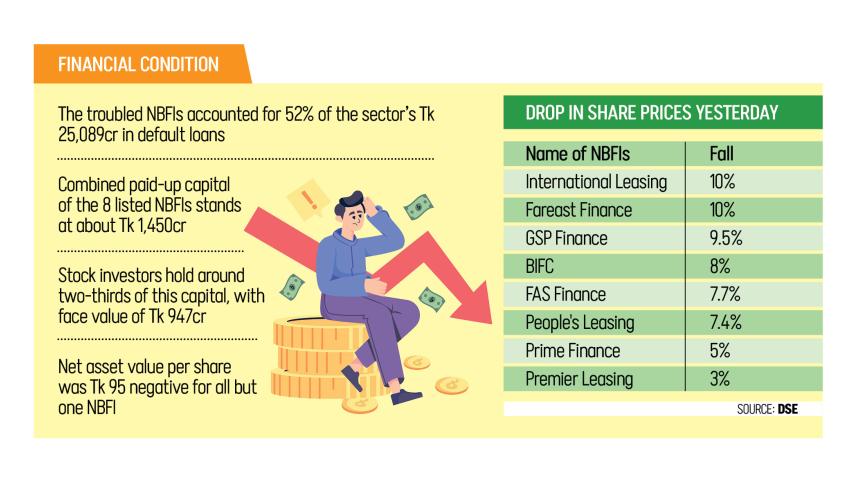

Sentiment had already been fragile after the merger of five banks wiped out an estimated Tk 4,500 crore in shareholder value, leaving many retail investors increasingly cautious. Now, with the regulator clearing the way for liquidating nine NBFIs, including eight listed ones, ordinary shareholders face potential losses of Tk 1,450 crore.

The combined impact sent alarm bells ringing across the capital market yesterday, with 83 percent of stocks on the Dhaka Stock Exchange (DSE) falling. Shares of 87 percent NBFI plunged as panicked investors rushed to dump their holdings.

Bangladesh Bank named FAS Finance, Bangladesh Industrial Finance Company (BIFC), Premier Leasing, Fareast Finance, GSP Finance, Prime Finance, People's Leasing, and International Leasing among the institutions selected for liquidation.

Following the announcement, shares of International Leasing, Fareast Finance, GSP Finance, BIFC, FAS Finance and People's Leasing fell by at least 8 percent, while Prime Finance dropped 5 percent and Premier Leasing 3 percent.

RUSHED SHARE DUMPING

Rashed Ahmed, a retail investor, ordered his broker yesterday to sell shares of a relatively well-performing NBFI despite its history of steady dividends.

"With eight listed NBFIs set to be liquidated, the negative impact could spread across the stock market, especially in the NBFI sector," he told The Daily Star. "I need to safeguard my investment from further erosion."

Many others took similar action, creating a selling spree across brokerage houses in Motijheel.

A stockbroker, speaking on condition of anonymity, said investors were selling "out of fear that NBFI liquidations could trigger another wave of panic, similar to the turmoil caused by the five bank mergers earlier."

"Whenever the market starts to recover, fresh negative news pulls it back into the red," he added.

The DSEX, the benchmark index of the DSE, fell roughly 400 points in the two weeks leading up to mid-November, dropping below 5,000 points for the first time in months, after regulatory announcements that shareholders of the merged banks were unlikely to get anything from their stake.

Though the index briefly rebounded past 5,000 points last week, it tumbled again after the NBFI liquidation news, closing at 4,914 points yesterday.

NO RECOVERY FOR SHAREHOLDERS

Shareholders of the selected NBFIs are also unlikely to recover any value from their shares.

The underlying concern is the net asset value (NAV) of the affected NBFIs – the difference between a company's assets and liabilities. Most of the eight listed firms have deeply negative NAVs, meaning their debts far exceed their assets.

As per the existing laws and rules, when assets are sold to repay creditors, ordinary shareholders are likely to get little or nothing, as they sit at the bottom of the payout hierarchy.

Financial reports show seven of the eight listed NBFIs have an average NAV of negative Tk 95 per share. Only Prime Finance had a marginally positive NAV of Tk 5.31 per share in 2023.

For small investors, it is another chapter in a difficult period. Although Bangladesh Bank has already taken a decision to wind up the listed firms, trading of these stocks remains operational at the stock exchanges.

Shahjahan Mia, an investor, said, "I still don't know if shareholders of the NBFIs will get anything back with the liquidation or not."

"It is unfair to punish general shareholders for the wrongdoings of sponsors of the companies," he added.

He called for taking strict action against sponsors of the NBFIs who were involved in fund embezzlement. For the benefit of stock investors, he urged the government to give some support.

LOST CAUSES

According to BB data, the eight NBFIs accounted for 52 percent of the sector's Tk 25,089 crore in defaulted loans at the end of last year. Twelve institutions alone carried 73.5 percent of all bad loans in the sector.

"This situation had been building for years," Saiful Islam, president of the DSE Brokers Association of Bangladesh, told The Daily Star recently.

"We warned that a financial crisis was brewing because banks and NBFIs were being drained. Their toxic loans grew so large that they had nothing left to rebuild with. Now, with liquidation coming, small investors are being hit hardest," he added.

Islam said many investors were misled because financial statements did not reflect the true extent of the problems.

"Auditors and credit rating agencies must be held accountable. Regulators, too, cannot avoid responsibility," he added.

In January, the central bank classified 20 NBFIs as financially "red-category" – meaning they had dangerously high defaulted loans and weak capital positions – and asked them to justify why their licences should not be cancelled.

Nine failed to provide satisfactory answers and have been put on the initial liquidation list.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments